March 27, 2024 | 5-minute read

March 27, 2024 | 5-minute read

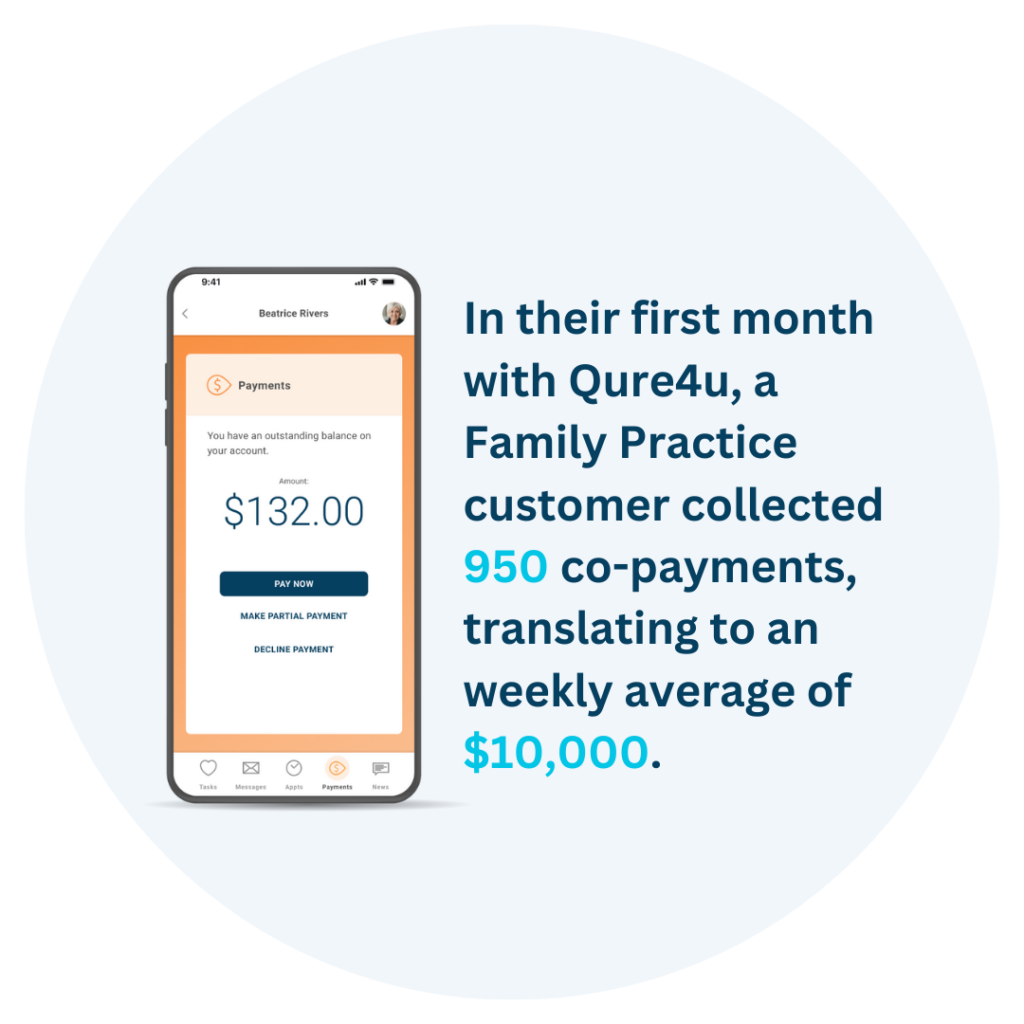

In 2024, healthcare providers must prioritize a digital-first approach that meets patients where they are at. Implementing mobile payments provides and smooth payment experience that increases collections.

According to a survey by US Bank, 44% of healthcare consumer pay medical bills faster when they receive digital or phone notifications about billing, and 49% would pay by text if available.

In light of these findings, traditional collection methods like phone calls and paper billing statements prove counterproductive, hindering cash flow and increasing accounts receivable. These outdated processes not only consume valuable staff resources but also prove less efficient and more costly compared to digital collection methods.

Implementing copays and outstanding balances helps you increase patient collections by enabling patients to pay prior to appointments via digital check-in. Set varying copay amounts based on appointment types, such as regular office visits versus orthopedic consultations. Enable convenient mobile payments, empowering patients to manage their healthcare expenses on-the-go.

Here’s the benefits you can expect to gain:

Securing outstanding balances is a critical aspect of increasing patient collections. Utilize secure texting to communicate with patients about their pending balances, incorporating transparency and convenience into the process. Enable patients to initiate payments directly through the digital check-in process. This integrated approach streamlines the payment process and provides patients with flexibility in managing outstanding balances.

Key features to focus on:

To further expedite and simplify the payment process, consider storing patients’ cards on file. This approach not only enables quick, hassle-free transaction; but requires no staff involvement. Patients can authorize automatic payments for copays, outstanding balances, and future services, reducing the likelihood of missed payments and increasing overall revenue.

Here’s a few of the benefits of this approach:

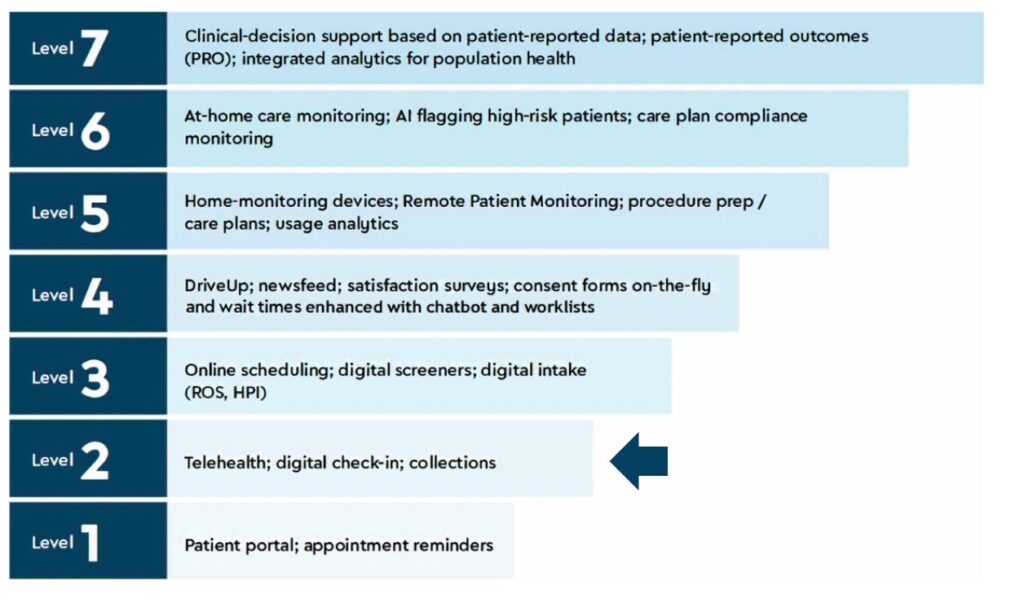

Incorporating these strategies into your practice can significantly boost revenue while aligning with Dr. Monica’s Seven Levels of Digital Care, particularly focusing on Level 2.

At Level 2, optimizing collections becomes a key aspect of your digital health strategy. By implementing efficient collection processes, you not only save time, get paid faster and reduce administrative burden but also gives patient the transparency they expect.

By automating pre-registration tasks (e.g., ensuring documents are in the patient chart, copays and balances are paid in advance, implementing one-click check-in for staff), you can expect to …

Developed by Qure4u founder and CEO Monica Bolbjerg, MD, The 7 Levels of Digital Care offer a comprehensive perspective on how digital technologies can be scaled to work together to best serve the unique needs of patients by putting the emphasis on clinical decision-making and ease of use. Numbers are based on a 40 provider group.

Want to learn more? Talk to us about how Qure4u can help you increase revenue and maximize collections.

If you’re uncertain about where to start, completing the SCORE4U assessment can help evaluate your organizational readiness and identify the best opportunities to increase patient acquisition and efficiency. You’ll get a report with your overall digital health score + scores for 9 components that are essential for practices looking to drive adoption, efficiencies, and better outcomes using digital patient engagement tools.

Qure4u Inc. 2024